[ad_1]

Paul Morigi

Overview

I recently read an article that stated Warren Buffett doesn’t buy real estate in the headline. Furthermore, in the article it stated Warren Buffett didn’t amass his fortune by buying real estate. After reading further, the article’s primary point was there are vehicles to gain exposure to real estate such as REITs. I completely agree. In the following piece, I will debunk the statement that Warren Buffett does not buy real estate and real estate has not helped him amass his fortune, just to set the record straight. I will then give my top REIT pick as of today. First let’s address the “Warren Buffett doesn’t buy real estate” and “hasn’t amassed his fortune from real estate” statements.

Buffett doesn’t buy real estate? I beg to differ.

This statement couldn’t be further from the truth. As a devoted follower of Warren Buffett’s investing exploits and being in the real estate business as a home builder and licensed Texas realtor for the past 21 years, I can tell you that Warren Buffett has probably bought more real estate that any other investor on earth to date. Warren Buffett’s Berkshire Hathaway (BRK.B) (BRK.A) bought Clayton Homes in 2002 for an all-cash offer.

I already know what you are going to say next. Berkshire Hathaway is not Warren Buffett. Well, the fact of the matter is Warren Buffett personally identified and negotiated the purchase of Clayton homes by Berkshire, and it’s actually a very interesting story.

Warren Buffett’s Clayton Homes Buy

So, yes Warren Buffett himself negotiated and bought Clayton Homes for an all-cash deal. Clayton Homes is now a subsidiary of Berkshire Hathaway. In 2002, Clayton Homes earned revenues of $1.2 billion. It was acquired by Berkshire Hathaway in 2003 for $1.7 billion. Buffett had already dipped a toe into the manufactured-housing market by investing more than $200 million in the debt of Oakwood Homes at the time. The way Warren Buffett became aware of Clayton Homes is actually a darn good yarn. What began as a cordial meeting quickly turned into one of Buffett’s toughest acquisitions. Let me explain.

Buffett’s Clayton Homes Buy backstory

University of Tennessee finance professor Al Auxier, and 40 members of the school’s Financial Management Association had flown to Omaha to visit Warren Buffett himself, thanks to a relationship cultivated over the years by Auxier.

Clayton Homes, is headquartered just outside Knoxville, in neighboring Maryville. Professor Auxier and Jim Clayton, the CEO of Clayton Homes at the time were friends. The group gave Buffett a copy of Clayton’s book “First a Dream” Clayton’s autobiography detailing his rise from the son of a cotton farmer to a mainstay on the Forbes 400 list of the wealthiest Americans as the founder of Clayton Homes. As the legend goes, Buffett was so inspired by Jim Clayton’s book that he decided to buy his company. Over the past 20 years Clayton Homes has grown by acquisition and organically to become the largest homebuilder in the United States, accounting for approximately half the industry’s total.

Clayton Homes is now the largest US home builder

As of 2019, Clayton Homes has 40 home building facilities and more than 350 retail outlets located across the United States. The company employs 16,000 people and produces about 50,000 homes per year at its facilities, which is about half of the industry’s total. Anyone who is in the real estate industry knows very well Warren Buffett buys real estate and real estate has been a key factor in how he has amassed his wealth. Now that we have debunked the diatribe that Buffett doesn’t buy real estate, let’s move on to the actual focus of this article. What REIT currently presents a buying opportunity? Well, as fate would have it, Warren Buffett actually owns even more real estate in the form of the REIT STORE Capital Corporation (NYSE:STOR), which I have on my watchlist as a solid retirement income buying opportunity. Let’s discuss.

Berkshire’s STORE Capital buy

Berkshire Hathaway invested $377 million in STORE Capital, representing 9.8% of total shares outstanding in 2017. Berkshire now holds 14.7 million shares for $417 million representing a 5.3% stake in the REIT.

About Store Capital

STORE Capital targets triple-net lease Single-Tenant Operational Real Estate properties. Under this model, STORE buys the properties from business owners and then leases them back to the owners.

Top Customers (Seeking Alpha)

Under a triple-net lease plan, the business owner/tenant is responsible for keeping the property in good shape, making repairs and renovations, and covering the insurance, property taxes, and other expenses.

STORE Customers (Seeking Alpha)

The company has been growing its investment portfolio and profits as well. Adjusted funds from operations (FFO) came in at close to $158 million in the first quarter of 2022, up about $32 million year over year.

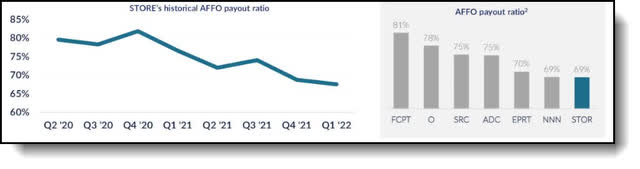

STORE Payout Ratio

AFFO Payout Ratio (Seeking Alpha)

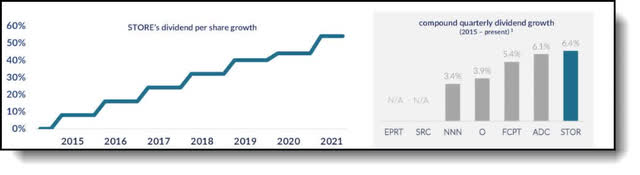

STORE Dividend Per Share Growth

Dividend Growth (Seeking Alpha)

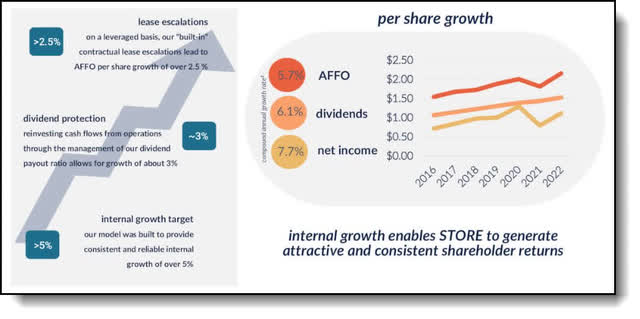

Per Share Growth (Seeking Alpha)

Total revenue also grew from approximately $182 million in the first quarter of 2021 to about $222 million in the first quarter of 2022. CEO Mary Fedewa actually raised guidance for the full year of 2022 during the last earnings call. CEO Mary Fedewa stated:

“In light of our first quarter performance, we are raising our acquisition and AFFO guidance for the year. Sherry will provide this updated guidance for 2022 in her remarks. We will then open the call to questions.

Our momentum from 2021 has continued through the first quarter of 2022. We acquired $513 million in profit center real estate, the highest first quarter volume in STORE’s history. These acquisitions were at an initial cap rate of 7.1% with weighted average annual lease escalations of 1.8%. Cap rates were right in line with our guidance. And our investment spread for the quarter was robust at approximately 340 basis points above our recent debt issuance.

This activity, along with the strong performance of our portfolio, resulted in solid AFFO of $158 million and AFFO per share of $0.57 for the quarter. Both were the highest in our history and have had a consistent upward trend for the past 4 quarters.”

Currently the valuation of STORE’s shares are quite reasonable. With STORE guiding for adjusted FFO to come in at $2.20 at the midpoint of its range in 2022, that means the stock is trading at about 12.5 times forward adjusted FFO. Moreover, the REIT”s tenant base is highly diversified, increasing the margin of safety substantially.

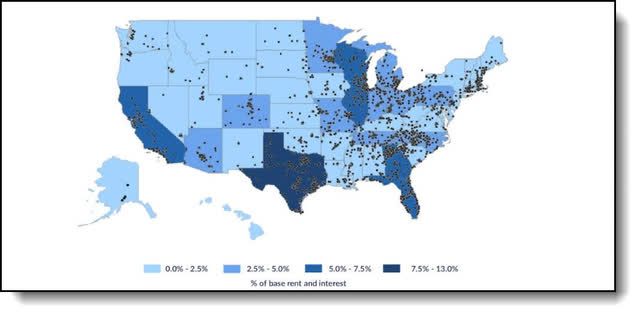

Geographically Diverse

Geographically Diverse (Seeking Alpha)

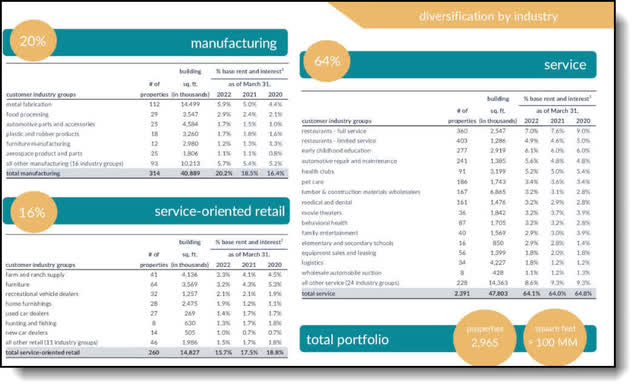

Highly diversified by industry

Diversified By Industry (Seeking Alpha)

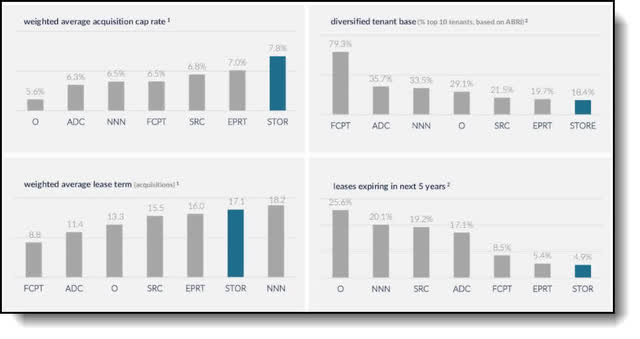

STORE’s investment approach results in attractive cap rates, diversification and lease duration.

Diversified Cap Rates and Duration (Seeking Alpha)

Now let’s wrap this up.

Key Takeaway

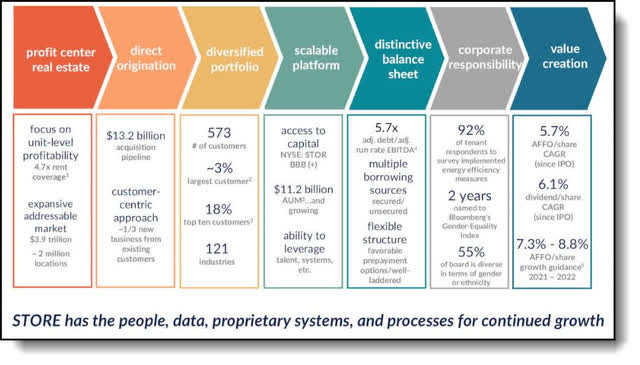

Even in the current environment of rising interest rates and inflation, STORE has the ability to drive growth with attractive spreads. STORE’s total addressable market is estimated to be approximately $4 trillion spread over two million properties. With such a vast total addressable market, STORE is able to be highly selective and choose only the companies that represent vital, sustainable and growing industries. With such a large total addressable market opportunity STORE has an extremely long runway to grow by selecting only the best-in-class business opportunities.

STORE Is A Best-In-Class REIT (Seeking Alpha)

One of STORE’s strategic advantages has always been its ability to identify and successfully acquire a large volume of granular transactions. This has been the company’s consistent strategy since inception. The approach allows STORE to price new leases from both a cap rate and rent escalation perspective which allows the company to account for the impacts of inflation and rising interest rates.

STORE is a well-diversified, profitable REIT that pays a well-covered dividend yielding 5.49%. What’s more, the company has been sold off recently based on the fact many in the market today are selling first and asking questions later in regards to a potential recession on the horizon.

STORE Current Chart (Seeking Alpha)

The stock is currently down 18% year-to-date and 24% off its 52 week high. I see 20% upside over the next 12 months coupled with the 5.49% yield that’s an approximately 25% total return over the next year. Even so, there may be more downside ahead. Nevertheless, I see the outsized pullback as a sign some of bad news may already be priced in. As Warren Buffett himself would say, “Be greedy when others are fearful!” Now that’s a proper ending to this piece!

Final thought

I hope you enjoyed the article. Those are my thoughts on the matter, I look forward to reading yours. Do you think STORE presents a buying opportunity presently? Why or why not. The true value of my articles lies in the prescient comments provided by the well-versed Seeking Alpha members in the comments section below. As always, I advise layering in to any new positions over time to reduce risk, my investing motto is “patience equals profits.” Furthermore, use this article as a starting point for your own due diligence.

[ad_2]

Source link

More Stories

Molina pivots to permanent remote work, plans to cut real estate footprint by two-thirds

A Successful Return for embedded world

Molina to cut two-thirds of leased real estate footprint