[ad_1]

porcorex/iStock by means of Getty Pictures

Superior-produce investing has admittedly grow to be somewhat easy in modern weeks, with even some blue-chip names these as Altria (MO) throwing off a around 9% yield. It can be easy to turn into jaded, having said that, as a person might acknowledge that this is the new norm, especially considering the present-day inflationary natural environment.

If history is of any indicator, however, it is that large dividends may perhaps not final without end, and that now might be a great time to invest in much more of one’s favourite stocks though also diversifying into other revenue sources.

This provides me to Horizon Know-how Finance (NASDAQ:HRZN), which now yields 10.4%, right after obtaining fallen from the $16 level just previously this calendar year to just $11.55 at current. In this article, I emphasize what will make HRZN a probably very good revenue portfolio diversifier, so let us get began.

Why HRZN?

Horizon Engineering Finance is an externally-managed BDC that supplies secured financial loans to undertaking capital and non-public equity backed growth organizations in the technologies, lifetime science, and healthcare facts and expert services industries.

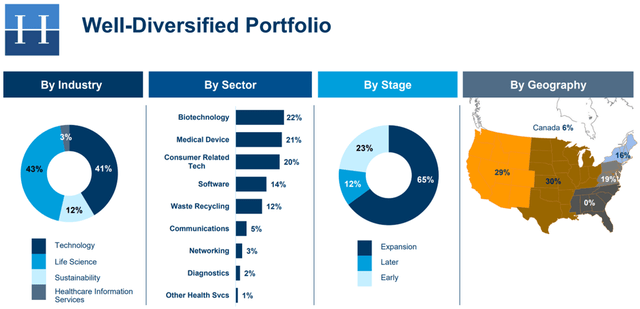

HRZN’s portfolio is effectively-balanced by business, with 41% of portfolio truthful benefit allotted to technology, 43% to everyday living science, 12% to sustainability, and the remaining 3% to health care information devices. As proven below, most of HRZN’s portfolio is allocated to corporations in the considerably less dangerous growth and afterwards stages, signaling maturity and additional line of sight.

HRZN Portfolio Blend (Trader Presentation)

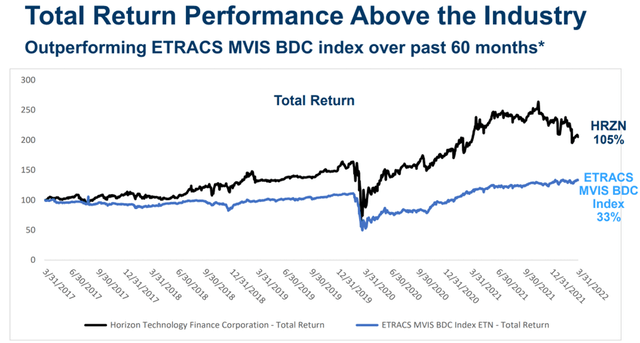

This technique has served HRZN very well, as demonstrated by its robust whole returns in excess of the earlier 5 several years, with a 105% total return from 3/31/2017 to 3/31/2022, beating the 33% full return of the ETRACS BDC Index, as shown underneath.

HRZN Whole Return (Investor Presentation)

In the meantime, HRZN is looking at stable fundamental fundamentals, with a high 14.9% common credit card debt portfolio generate over the trailing 12 months, despite the fact that this has cooled a bit to a continue to robust 12.4% all through the first quarter. HRZN is also viewing spectacular portfolio progress of 36% in excess of the previous yr, to $515 million.

Moreover, HRZN maintains a reduced danger profile, thinking of that its borrowers have on average a low 20% mortgage to worth ratio, evaluating favorably to the 80% LTV regular for mid-industry financial loans.

This small-risk approach is reflected by the point that HRZN has just one particular expenditure, MacuLogix, on non-accrual, with management anticipating for it to resolve itself over the present and subsequent quarter when injecting a tiny amount of money of liquidity to make it transpire. In addition, management estimates that virtually 96% of the portfolio carries a risk-free 3-ranking or far better.

Notably, HRZN is at this time beneath-earning its $.30 quarterly dividend charge (paid out month-to-month) with $.26 NII for every share in the course of the very first quarter, getting to do with seasonably gentle prepayments. Nevertheless, HRZN has loads of cushioning to address its dividend charge, with $.47 per share of undistributed spillover cash flow from prior portfolio liquidity events.

It also has a massive addressable market and lots of firepower to fund its pipeline, with a reduced .9x personal debt to fairness ratio, sitting well underneath the 2.0x statutory limit. This was mirrored by administration through the the latest conference simply call:

Our advisor carries on to greatly enhance the Horizon system with added hires and promoting members of its crew into essential management positions, guaranteeing we continue being on system to produce future progress and continued profitability.

The added benefits of the Horizon system contain: an expanded lending platform and the energy of the Horizon manufacturer to entry a larger variety of investment decision possibilities, a pipeline of investments that has hardly ever been larger sized, increased capability to execute on a backlog of commitments and new options and an seasoned that is cycle-tested and thoroughly well prepared to deal with by means of opportunity macro or financial headwinds.

In the vicinity of-term hazards to HRZN include the downturn in advancement, particularly tech, stocks since the start of the yr, and this may perhaps have a unfavorable effect on HRZN’s portfolio price. On the other hand, this may well be short term, and delayed liquidity events these as an IPO or buyout may outcome in heightened need for HRZN’s loans, as portfolio companies might want to stay clear of dilutive equity gross sales to venture money and personal equity companies.

Last of all, the new share selling price weak point has produced HRZN more attractive. It at the moment carries a selling price to e book price of .99x, sitting perfectly underneath its vary around the earlier 3 years, outside the house the early pandemic interval. Promote facet analysts have an ordinary rate concentrate on of $14.13, implying a potential a single-year 33% full return including dividends.

HRZN Value to Ebook (Searching for Alpha)

Investor Takeaway

Horizon Know-how Finance is a small but rising BDC that has observed outstanding overall returns above the past 5 decades, prior to the recent downturn. It is benefiting from powerful underlying fundamentals, with strong portfolio advancement and produce. With the the latest share rate weak point, HRZN seems to be an attractive purchase for high revenue buyers searching for month to month dividends and cash appreciation likely.

[ad_2]

Source url

More Stories

Experts Weigh In On Voice Control Technology’s Pros, Cons And Future

Max Scherzer’s thoughts on PitchCom: ‘It should be illegal’

Coding skills are in demand, but companies want more from technology professionals