[ad_1]

Marat Musabirov/iStock by using Getty Images

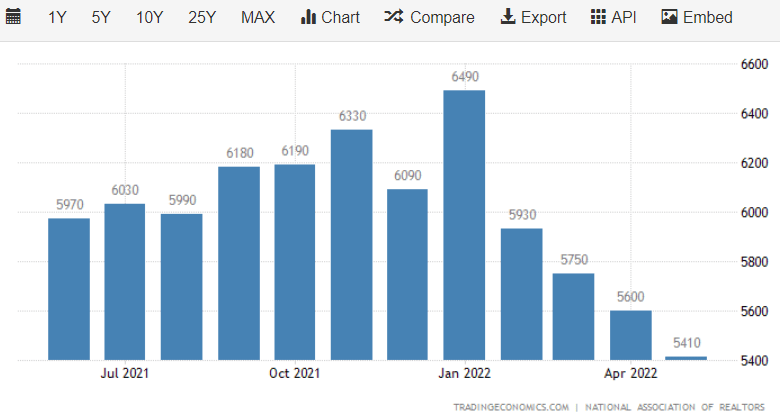

Serious Estate exchange traded resources uncover them selves front and center as Existing Property Gross sales details for the thirty day period of May declined now in 4 straight months dating again to Jan. 2022.

Might Existing Residence Product sales figures arrived in at -3.4% to 5.41M when compared to the forecasted 5.40M which was anticipated and 5.60M prior determine that was revised from 5.61M. See under chart of month in excess of thirty day period house product sales.

As weaker data hits the industry traders change their notice to resources like the SPDR Homebuilders ETF (XHB), iShares Home loan True Estate Capped ETF (BATS:REM), iShares Residential Serious Estate Capped ETF (REZ), and Hoya Funds Housing ETF (HOMZ).

At the exact same time massive benchmark ETFs that observe the broader serious estate market place also come across them selves on the map. Three examples are the Serious Estate Select Sector SPDR ETF (NYSEARCA:XLRE), Vanguard Serious Estate ETF (NYSEARCA:VNQ), and the iShares U.S. True Estate ETF (NYSEARCA:IYR).

Furthermore, of the 11 S&P 500 sectors the real estate phase finds by itself sitting down in eighth area in 2022 soon after coming in 2nd in 2021.

Yr-to-date cost motion: XHB -36.8%, REM -26.2%, REZ -19.8%, HOMZ -29.5%, XLRE -22.7%, VNQ -22.1%, and IYR -22.3%.

“Residence product sales have essentially returned to the amounts viewed in 2019 — prior to the pandemic — after two many years of gangbuster functionality,” mentioned Lawrence Yun, National Affiliation of Realtors’ main economist.

[ad_2]

Supply link

More Stories

Molina pivots to permanent remote work, plans to cut real estate footprint by two-thirds

A Successful Return for embedded world

Molina to cut two-thirds of leased real estate footprint