During Starbucks’ (SBUX) second-quarter conference call this week, executives made it clear that it’s not just a coffee company. Starbucks is a tech company, too.

In fact, the word “mobile” was used 24 times on that call.

CEO Kevin Johnson, who just took the helm from founder Howard Schultz, is a veteran of Microsoft (MSFT) and Juniper Networks (JNPR). And he emphasized that the company’s laser-focus on technology could help insulate it from the woes of retail.

“Looking to the future, this is all about how our digital relationships with customers intersect with experiential retail in our stores,” Johnson said. “We are confident that we’re well on our way to further increasing overall store capacity while delivering enhanced Starbucks experience to our customers.”

Mobile focus

Starbucks’ focus on its digital strategy has started to turn around disappointing comparable store sales, Johnson said. In its latest quarter, the company posted 3% comparable sales growth, the fifth consecutive quarter of comp growth 1 point below consensus estimates.

But by the end of the quarter, 1,800 of the company’s US stores were experiencing 20% or more of peak transactions from Mobile Order & Pay.

The company ended the quarter with 13.3 million active Starbucks Reward members in the US, up 11% year-over-year. And 44% of all transactions (including gift cards) in the quarter were prepaid on the company’s proprietary payment platform.

Starbucks is still trying improve its digital customer service. Currently, it’s working on a new Digital Order Manager, or DOM, a tablet-based device that provides baristas with visibility on incoming orders and allows for better tracking and real-time order management. Starbucks is also re-thinking store layout and design to coordinate with this new in-store equipment.

Johnson said the company is now focused on personalization and more social gifting partnerships that builds on the company’s partnership with Chinese company Tencent.

‘A seismic shift in consumer behavior’

These digital efforts, along with aims to make visits more “destination oriented,” remain key for the restaurant space amid a struggling retail environment.

Johnson pointed to a recent Wall Street Journal article noting more retail stores have closed in the first quarter of calendar year 2017 than closed in all of 2016. More are expected to close this year than during the recent recession.

“The article illuminated once again the seismic shift in consumer behavior underway and the devastating impact that this sea change in behavior is having on many traditional brick and mortar retailers,” Johnson said. “The analogy from my years in the tech industry is how companies respond when a new disruptive technology, like cloud computing, for example, emerges. Those who recognize the disruption think long term and innovate for the future are big winners. Those who don’t struggle.”

The leaders in digital: Dominos and Panera

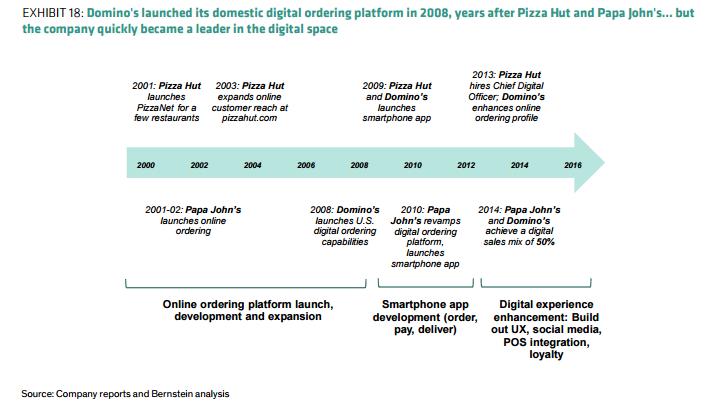

Starbucks is not the only restaurant chain to think like a tech company. The pizza delivery market has been a leader when it comes to mobile ordering, with Dominos (DPZ) the pioneer. Its Domino’s Tracker, which launched back in 2009, demonstrated the company’s forward-thinking approach by providing real-time updates on an order.

The company has also broadened its order options, allowing customers to order through Facebook Messenger or Google Home…. and even via emoji. The company has also been testing self-driving cars and drone delivery.

Domino’s digital orders now make up more than half of the company’s sales, well ahead of the 20% industry average.

Meanwhile, Panera (PNRA), which announced it will be acquired by JAB Holdings, has seen traction from its more recent efforts to invest in digital. It unveiled “Panera 2.0” in 2014 and digital orders comprise 26% of sales as of its latest quarter.

Other restaurant companies are trying to emphasize mobile growth, including McDonald’s (MCD), Buffalo Wild Wings (BWLD) and Dunkin Brands (DNKN).

During the Starbucks conference call, Howard Schultz, who now serves as executive chairman of the company, emphasized the importance of digital growth for brick-and-mortar companies like these.

“You have to believe that in order to win and win big, domestically and globally in this new environment,” he said, “that a company’s capability and competency as a four-wall bricks and mortar retailer must be as good digitally and on mobile in all things that make the brand as relevant outside of the store and on a mobile device as it is inside the four walls of the store.”

Nicole Sinclair is markets correspondent at Yahoo Finance.

Please also see:

Dominos CEO: We got ahead of the curve in technology

Panera CEO reveals how they’re beating the long decline in shopping malls

Why O’Reilly’s firing hasn’t hit Fox stock

Citigroup CEO on Trump’s policy changes: ‘It’s a matter of when and not if’

Jamie Dimon supports an earned income tax credit for low-skilled, low-paid workers

More Stories

Experts Weigh In On Voice Control Technology’s Pros, Cons And Future

Max Scherzer’s thoughts on PitchCom: ‘It should be illegal’

Coding skills are in demand, but companies want more from technology professionals